- Business

- Childbirth & Education

- Legal Formalities

- Motoring

- Other

- Pensions & Benefits

- Property & Accommodation

- Taxes

- Airports and Airlines Spain

- Paramount Theme Park Murcia Spain

- Corvera International Airport Murcia Spain

- Join us for Tea on the Terrace

- When Expat Eyes Are Smiling

- Meet Wincham at The Homes, Gardens & Lifestyle Show, Calpe

- QROPS 2014

- Spain Increases IHT in Valencia & Murcia

- Removals to Spain v Exports from Spain

- The Charm of Seville

- Gibraltar Relations

- Retiro Park : Madrid

- Community Insurance in Spain

- Calendar Girls

- Considerations when Insuring your Boat in Spain

- QROPS – HMRC Introduces changes that create havoc in the market place

- QROPS – All Change From April 2012

- Liva & Laia : 15th November

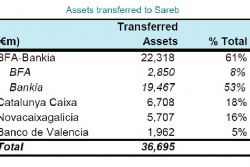

Spain's bad bank SAREB announced a slightly lower-than-expected return on equity in a new business plan approved on Wednesday for the entity's 15-year lifespan.

SAREB, the asset management company created by the government at the end of last year to house soured property assets, said it would offer a return on equity of between 13 - 14% versus initial expectations for a return of 14 or 15%.

The bank is still trying to complete its capital and shareholder structure but said in a statement that the approval of the business plan was a key step in allowing it to start managing its assets, worth about €50.4 billion.

The majority of the real estate assets come from nationalised lenders such as Bankia, Catalunya Banc, NCG and Banco de Valencia, all of which have suffered from a burst property bubble and prolonged economic recession.

SAREB said it plans to sell almost 50% of the buildings and homes within the first 5 years of operation.

The bank, launched to comply with the terms of a €40-billion European rescue of Spanish banks, said it expected to generate 75% of its revenues through property sales and the remaining quarter by selling loans.